| Client |

$100 million US-headquartered, privately held, domestic manufacturer of consumer products with several items representing the No. 1 product in their categories. |

| Situation |

The CEO became increasingly concerned with the company’s ability to identify and effectively manage important risks, as a result of a few unforeseen compliance issues identified during an inspection by a US regulatory agency. |

| Solution/Approach |

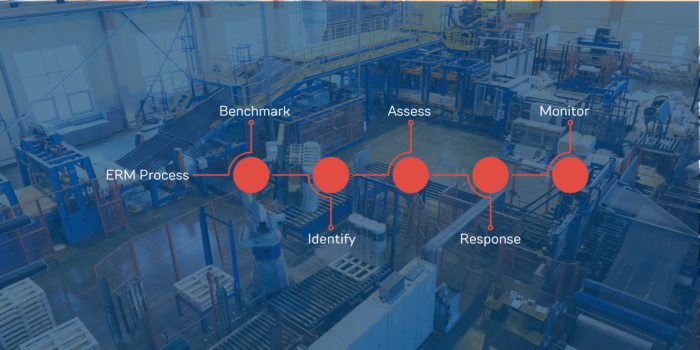

Facilitated offsite retreat with selected managers from all functions across the organization. |

|

- Conducted selected interviews of executives and senior managers prior to the retreat.

|

|

- Anonymously surveyed all retreat participants prior to the start of the retreat regarding their understanding of ERM and perceptions of the organization’s risk posture.

|

|

- Presented research regarding ten common risk factors and the application of common factors to recent, high profile corporate governance and risk management failures of larger enterprises, as well as smaller organizations. Applied the risk factors to a recent event within the company itself.

|

|

- Established an enterprise-wide understanding of “risk appetite” from both a quantitative and qualitative perspective, as well as “risk tolerance.”

|

|

- Facilitated smaller group discussions to identify and debate the top risks faced by the organization.

|

|

- Developed a list of top 17 risks from across all groups, and collectively prioritized the most important risks.

|

|

- Facilitated separate, smaller group discussions to develop and debate more effective risk response strategies for each of the top risks.

|

|

- Facilitated the selection of “risk champions” and their underlying teams to manage, and periodically report changes to such risks, as well as emerging risks, to Senior Executive Management and the Board of Directors.

|

|

- Presented the enterprise risk assessment to all members of the Board and Executive Management. The Board requested a periodic (i.e., quarterly) ongoing update of all risks and mitigating activities identified.

|

| Outcome/Benefit |

FOCUS: the CEO was able to leverage this exercise to focus his team on the most important issues facing the organization. |

|

COST REDUCTION: Reduced D&O and General Liability insurance premiums. In addition, the Quality Risk team acquired a specialty application/tool that resulted in $800,000 of reduced cost associated with an unexpected and immediate product recall by the vendor of a product’s key ingredient generating an ROI of 80:1 for the tool. |

|

REALIGNMENT & CAPITAL ALLOCATION: a re-alignment of several risk response strategies that incorporated the collective views of the senior leadership team, and a transparent re-prioritization of capital allocation to addressing the most pressing risks faced by the organization. |

|

CADENCE: The ERM program structure established a “play-book” for management to respond to a second, unexpected and unrelated crisis invoked by a Federal regulator within a year of the retreat. |

|

COMPLIANCE: a report to share with the regulators demonstrating a high level of commitment in management’s response to issues identified. |

|

MONITORING: improved focus on monitoring activities for selected risks. |