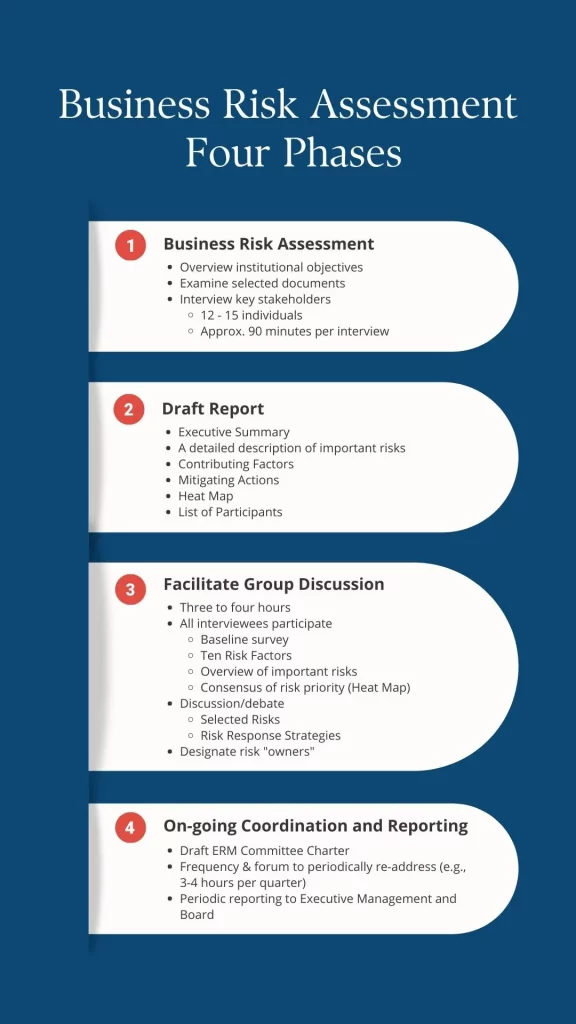

Our strategic business risk assessment services evaluate the most important risks, as opposed to the hundreds or thousands of trivial risks that may inherently impact an organization. The business risk assessment process includes an evaluation of activities that mitigate or reduce individual risks, called risk response strategies and tactics. Risk response strategies and tactics span a variety of activities. Examples include:

- The use of various insurances

- The best use of personnel, adding or changing skills, and training

- New or improved uses of technologies

- Instituting defined protocols and procedures