Life sciences risk management is essential for organizations navigating the complexities of regulatory compliance, innovation, and patient safety. In a rapidly evolving industry, effective life science risk management strategies help companies identify potential threats, maintain operational efficiency, and protect their reputation. From pharmaceutical firms to biotech startups, life science organizations’ risk management plays a critical role in ensuring product quality, data integrity, and long-term success in a highly regulated environment.

Life Sciences Risk Management

What Is Life Science Risk Management?

Life science risk management involves identifying, evaluating, and addressing potential risks that could impact research, product development, regulatory compliance, operational and financial reporting, and patient safety within the life sciences sector. This includes biotechnology and pharmaceutical companies, medical device manufacturers, and related organizations operating in a highly regulated and innovative environment.

Key Objectives Of Life Sciences Risk Management:

- Protect intellectual property, data integrity, and research outcomes.

- Ensure compliance with industry-specific regulations, such as FDA, EMA, the European Commission, and HIPAA standards.

- Minimize risks associated with clinical trials, product liability, and supply chain disruptions.

- Ensure sufficient cash flow, access to capital and integrity of financial reporting.

- Strengthen operational continuity and reputation management across all stages of development and commercialization.

Effective life science risk management strategies enable organizations to anticipate and respond to complex challenges while maintaining innovation and compliance. A well-structured life science organization’s risk management framework supports long-term success and enhances stakeholder confidence in an increasingly competitive and scrutinized industry.

Life Science Client Testimonial

John has provided highly valuable and practical insights into our risks, processes, and controls

as they have developed in depth and complexity during our transition from a late-stage clinical

biopharmaceutical development company to a pre-commercial enterprise. His experience in life

sciences, combined with a strategic business mindset and a significantly lower cost structure,

has offered substantial value to our organization, particularly in regard to our compliance

initiatives related to SOX 404.

Joseph M.

Vice President & Controller

Publicly Traded, Pre-Commercial Biopharmaceutical Company

FAQs For Life Sciences Risk Management

Life sciences risk management presents unique and complex challenges due to the industry’s dynamic nature, strict regulatory oversight, and continued access to capital to fund innovation. Life science organizations must navigate these challenges while ensuring product safety, operational efficiency, and regulatory compliance.

Top Challenges In Life Sciences Risk Management:

- Regulatory Compliance: Life science risk management must account for evolving global regulations, such as FDA, EMA, and GDPR requirements. Noncompliance can lead to costly penalties and delayed product approvals.

- Clinical Trial Risks: Managing the safety, integrity, and data security of clinical trials is a major focus of life sciences risk management. Risks include adverse events, patient privacy issues, and trial delays.

- Supply Chain Vulnerabilities: Life science organizations’ risk management must address disruptions in sourcing raw materials, manufacturing, and distribution, which can significantly affect product availability and quality.

- Data Security and Cyber Threats: As digital health solutions and data analytics grow, life science risk management must include robust cybersecurity measures to protect sensitive intellectual property and patient data.

- Product Liability: A core part of life sciences risk management is mitigating risks tied to product defects, side effects, or recalls that can damage reputation and financial stability.

- Reliance on Third Parties: Many biotech and pharma companies rely on a variety of third parties to conduct preclinical and clinical trials, contract development and manufacturing, and logistical activities. However, the use of these third parties does not relieve management of their regulatory responsibilities.

- Innovation and Speed to Market: Balancing innovation with thorough risk assessments is essential. Life science organizations’ risk management frameworks must support agile development while ensuring compliance, safety, and sufficient capital to fund innovation.

Addressing these challenges requires a proactive, integrated approach to life science risk management that aligns operational goals with regulatory expectations and stakeholder trust.

ERM Exchange identifies risk factors in life science companies by using a structured and collaborative approach tailored to the unique challenges of the industry. Through specialized tools and expert-driven assessments, ERM Exchange helps organizations uncover vulnerabilities across operations, finance, compliance, and innovation pipelines.

Key Ways ERM Exchange Supports Life Sciences Risk Management:

- Industry-Specific Risk Assessments: ERM Exchange evaluates risks related to clinical trials, regulatory compliance, supply chain, operational and financial reporting, and product development—critical components of effective life sciences risk management.

- Stakeholder Collaboration: By engaging leadership, operations, finance, sales & marketing, legal & compliance teams, and R&D professionals, ERM Exchange ensures that all perspectives are considered in the life science risk management process.

- Regulatory Mapping And Gap Analysis: ERM Exchange assists management in analyzing existing practices against global regulatory standards to help life science organizations’ risk management teams identify compliance gaps before they become liabilities.

- Financial Reporting & Compliance: ERM Exchange through our affiliate, The Audit Exchange, assists management with establishing, evaluating, documenting and testing internal controls over financial reporting in the context of Sarbanes-Oxley Section 404 compliance.

- Technology And Data Integration: ERM Exchange assists management in the use of advanced analytics and risk dashboards to provide real-time insights that support decision-making and early risk detection in complex life science environments.

- Scenario Planning And Stress Testing: ERM Exchange helps organizations model potential disruptions, from clinical trial delays to cybersecurity breaches, strengthening the foundation of life science organizations’ risk management strategies.

Through this comprehensive approach, ERM Exchange empowers companies to enhance their life sciences risk management practices, ensuring long-term resilience, regulatory readiness, financial reporting integrity, and innovation continuity.

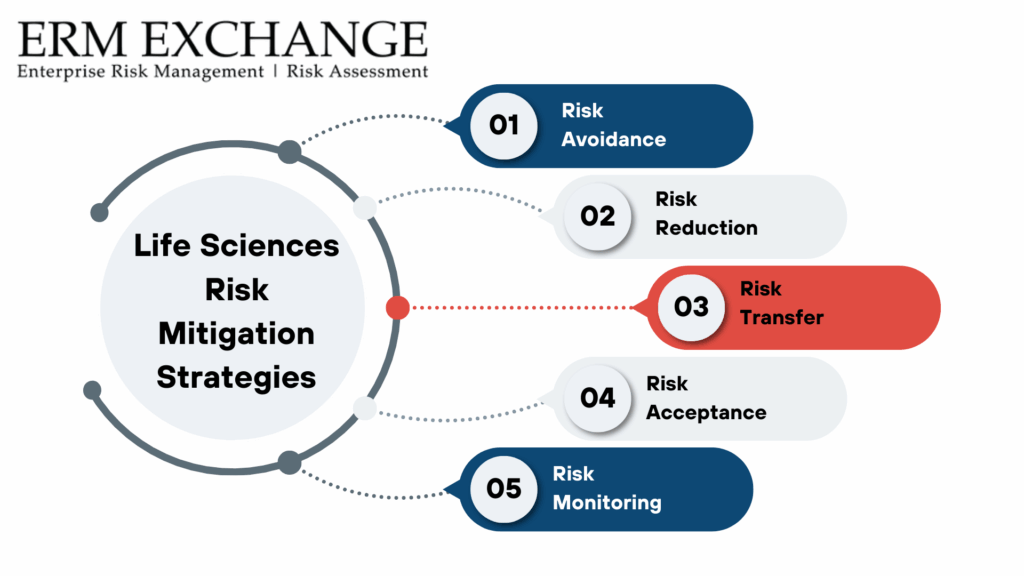

Once risks are identified, effective management is essential to protect operations, ensure compliance, and support innovation. A structured response plan is critical for strengthening life sciences risk management and minimizing the potential impact of these risks on business performance and patient safety.

Key Steps to Manage Risks in Life Science Risk Management:

- Risk Prioritization: After identification, risks are ranked based on likelihood and potential impact. This helps focus resources on the most critical areas of life science risk management.

- Mitigation Planning: Targeted strategies are developed to avoid, reduce, transfer, eliminate, or in certain cases, accept risks. These can include process improvements, staff training, or enhanced quality controls.

- Regulatory Compliance Monitoring: Continuous oversight ensures all risk responses align with evolving global regulations—a crucial part of life sciences risk management.

- Crisis Response Protocols: Organizations should establish clear procedures to respond quickly to events such as data breaches, product recalls, or clinical trial issues.

- Ongoing Risk Review: Life science organizations’ risk management requires regular monitoring, testing, and updating of controls to stay ahead of emerging threats and maintain operational integrity.

- Communication and Reporting: Transparent communication across departments and with external stakeholders reinforces accountability and builds trust.